How to Fax your Tax Forms to the IRS

Easily Fax Tax Forms to the IRS with Faxaroo

Every year millions of U.S. citizens file their taxes with the IRS. If you have been filing paper tax returns or reside overseas, the quickest way to file your tax forms is to send a fax to IRS.

Did you know that if you can fax files to the IRS?

Local fax services are available, however if you'd prefer to fax from the comfort of your home then look no further than Faxaroo - the best online fax service, with no accounts or contracts, simply pay per fax page. It's the most reliable way to send your tax forms to the IRS using a computer or mobile.

Why Choose Faxaroo for IRS Faxing?

Faxaroo’s online self-service portal allows you to send a fax to an IRS fax number in minutes, without waiting in line or visiting a Staples, FedEx, UPS or Office Depot stores.

Filing your tax forms is critical and we know that you need a reliable and secure way to fax your tax forms to the IRS. Physical fax machines are more secure than sending forms to the IRS via email. When sending via email you will not receive confirmation of successful delivery like you would for a fax delivery. By faxing to the IRS you will know that your tax forms have been safely received.

Free online fax services may be unencrypted, require you to sign up for a plan and have unknown fees that end up costing you extra. Faxaroo’s simple pay per fax service means you know exactly how much it will cost to send a fax via Faxaroo.

With Faxaroo, you get:

- No hidden fees – Pay only for what you send.

- No accounts, subscriptions or contracts – No logins, or passwords. Simply upload your fax.

- Secure efaxing – Your documents are handled with care and confidentiality. Faxaroo is ISO 27001 certified, encrypted and processed via TLS encryption for ultimate security.

- Instant confirmation – Know your fax was successfully sent.

IRS Fax Numbers

IRS Form Number | Description | IRS Fax Number |

Form 8918 | Reportable Transaction Disclosure Statement | 1-844-253-5607 |

Form 8806 | Information Return for Acquisition of Control | 1-844-249-6232 |

Form 8023 | Tax-Free Reorganization | 844-253-9765 |

Form 8886 | Reportable Transaction Disclosure Statement (RTDS) | 844-253-2553 |

Form 2553 | Election by a Small Business Corporation | 855-887-7734 (CT, DE, DC, GA, etc.) 855-214-7520 (AL, AK, AZ, AR, CA, CO, FL, etc.) |

Form 637 | Application for Registration (Excise Tax) | 855-887-7735 |

Form 8962 | Premium Tax Credit | 1-855-204-5020 |

Form SS-4 | Application for Employer Identification Number (EIN) | 855-641-6935 (within the US) 304-707-9471 (outside the US) |

Form 1040 | Individual Tax Return | Cannot be faxed directly to IRS. It can only be faxed to your accountant who can file on your behalf. |

Form 2848 | Power of Attorney and Declaration of Representative | Fax numbers available at - https://www.irs.gov/instructions/i2848 |

Form 8809 | Request for Extension of Time to Furnish Statements to Recipients | 877-477-0572 (within the US) 304-579-4105 (outside the US) |

Form 3115 | Application for Change in Accounting Method | 844-249-8134 |

Form 8233 | Exemption From Withholding on Compensation for Non-resident Alien | 267-941-1365 |

Form 8850 | Pre-Screening Notice and Certification Request for Credits | Fax numbers available at: https://www.dol.gov/agencies/eta/wotc/contact/state-workforce-agencies |

Form 8505 | Request for Electronic Filing Waiver (for those facing hardship) | 877-477-0572 (within the US) 304-579-4105 (outside the US) |

Form 8802 | Application for United States Residency Certification | 877-824-9110 (within the US, toll free)

|

IRS fax numbers sourced from the IRS website.

List of IRS Forms and IRS Fax Numbers

IRS Form SS-4

IRS Form SS-4 is used to apply for an Employer Identification Number (EIN). You can fax your completed form to the IRS using the appropriate fax number based on your location:

For businesses, offices, or legal residences in any of the 50 states or the District of Columbia: 855-641-6935

For those without a legal residence, place of business, or principal office in any state:

Within the U.S.: 855-215-1627

Outside the U.S.: 304-707-9471

Explore all instructions for Form SS-4

IRS Form 8918

Form 8918 is used to report participation in "reportable transactions," which the IRS considers to have potential tax avoidance risks.

IRS Form 8918 Fax Number: 1-844-253-5607

Learn more about Form 8918

IRS Form 8806

Business owners must file Form 8806 within 45 days of acquiring control or undergoing a significant capital structure change during mergers or acquisitions.

IRS Form 8806 Fax Number: 1-844-249-6232 (fax submissions only)

Learn more about Form 8806

IRS Form 8023

Used for corporate asset or stock transfers as part of tax-free reorganizations.

IRS Form 8023 Fax Number: 844-253-9765

Learn more about form 8023

IRS Form 8886

Also known as the Reportable Transaction Disclosure Statement (RTDS), this form reports transactions that may lead to tax avoidance or evasion. Each form must be faxed separately.

IRS Form 8886 Fax Number: 844-253-2553

Learn more about Form 8886

IRS Form 2553

This form allows small businesses to elect S Corporation tax status.

IRS Form 2553 Fax Numbers by State:

855-887-7734 — Connecticut, Delaware, District of Columbia, Georgia, etc.

855-214-7520 — Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, etc.

Explore S Corporation IRS Forms

IRS Form 637

Required for individuals registering with the IRS for excise tax-related activities (e.g., alcohol, fuel, firearms, tobacco).

IRS Form 637 Fax Number: 855-887-7735

Learn more about Form 637

IRS Form 8962

Used for taxpayers who received premium tax credits to help pay for health insurance.

IRS Form 8962 Fax Number: 1-855-204-5020

Learn about Form 8962

IRS Form 1040

This is the standard form for filing federal income tax returns. While you can’t fax it directly to the IRS, you can send it to your accountant, who can file it by mail or online.

IRS Form 2848

Grants Power of Attorney to a qualified representative for IRS dealings.

IRS Form 2848 Fax Number: Available on IRS instructions

Explore instructions for Form 2848

IRS Form 8809

This form requests extra time to file the following tax documents:

W-2, W-2G,

1042-S,

1094-C, 1095,

1097, 1098, 1099,

3921, 3922,

5498, and

8027.

IRS Form 8809 Fax Numbers:

877-477-0572 (within the U.S.)

304-579-4105 (outside the U.S.)

IRS Form 3115

Use this form to change an accounting method or treatment of a specific item.

IRS Form 3115 Fax Number: 844-249-8134

IRS Form 8233

Non-resident aliens use this form to claim exemptions from U.S. tax withholding based on tax treaties or personal exemptions.

IRS Form 8233 Fax Number: 267-941-1365

Learn more about Form 8233

IRS Form 8850

Employers submit this form to their state workforce agency (SWA) for Work Opportunity Tax Credit (WOTC) eligibility verification.

IRS Form 8850 Fax Numbers: Available through state workforce agencies

Form 8850 fax numbers are available here.

IRS Form 8505

This form can be faxed if the filer qualifies for a hardship waiver from electronic filing.

IRS Form 8505 Fax Numbers:

877-477-0572 (within the U.S.)

304-579-4105 (outside the U.S.)

IRS Form 8802

This IRS Form 8802 is used to request U.S. Residency Certification for tax treaty benefits in foreign countries.

How to Fax IRS Forms with Faxaroo

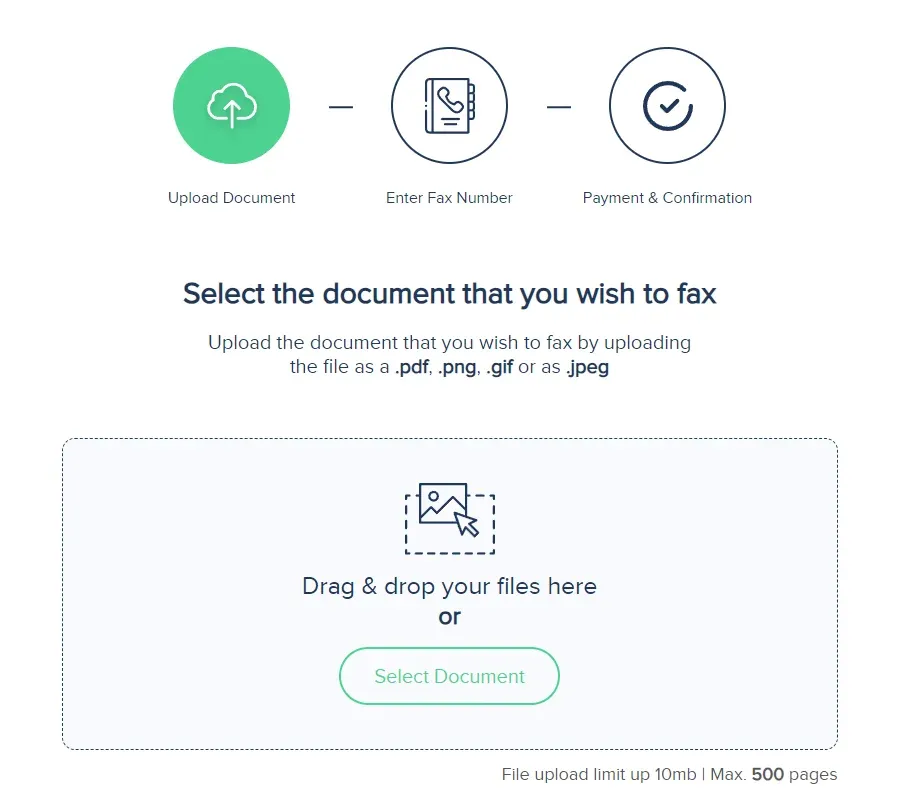

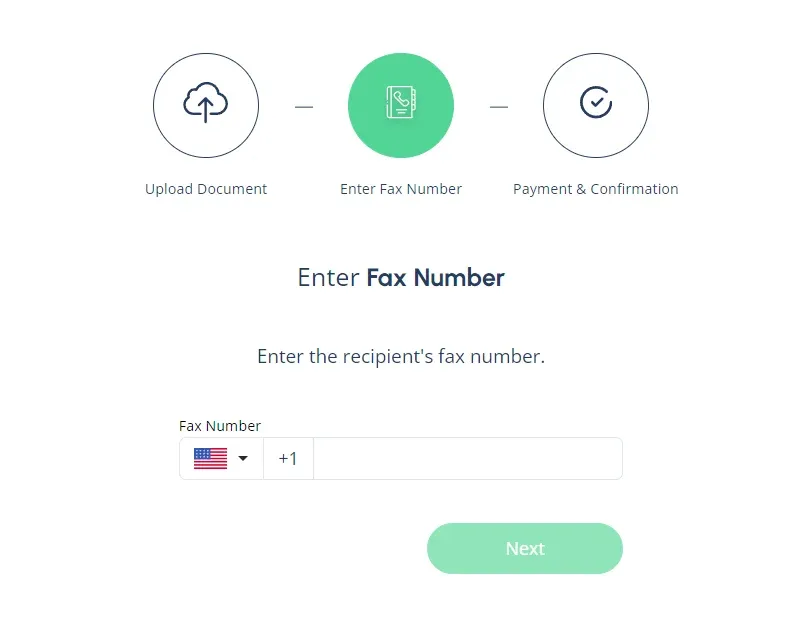

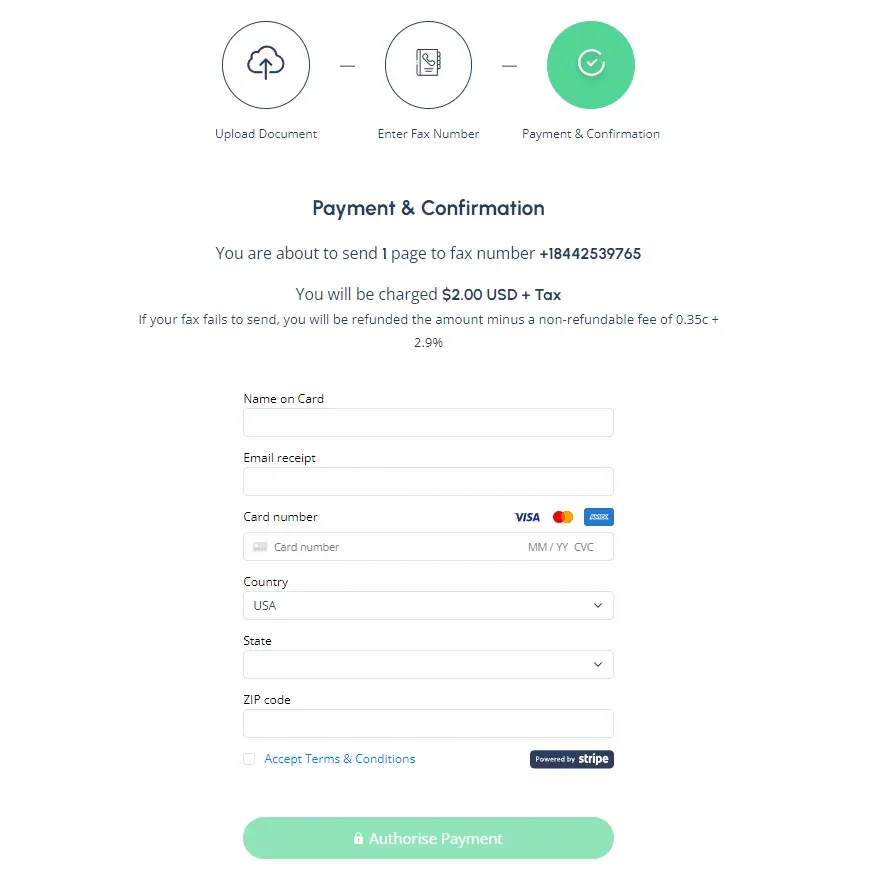

Faxing your tax documents to the IRS is quick and easy with Faxaroo:

1. Upload your fax document to Faxaroo’s secure web portal by selecting the document from your device or using our easy drop and drag feature. Faxaroo supports multiple file formats including PDF, PNG, GIF and JPEG. Simply save your tax forms as a document and send a fax to the IRS without worrying about incompatibility issues.

2. From the drop-down menu, select the USA and enter the correct IRS fax number for your tax form. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. We’ve compiled a list of IRS fax numbers for your convenience below.

3. Select your payment method. Once you’ve entered the correct fax number, the final step is to confirm payment. Faxaroo accepts payment via Visa or Mastercard. You’ll only be charged per page sent.

Choose Faxaroo for IRS Faxing

Accessibility: Faxaroo is compatible with all devices—smart phones, tablets, and computers—allowing you to send faxes fast while on the go.

Environmentally Friendly: Reduce paper waste with Faxaroo's digital faxing, contributing to a greener planet.

Reliability: Faxaroo provides instant fax confirmation of fax delivery via email, giving you peace of mind that your documents have reached their destination.

Low-cost fax: With Faxaroo, there are no hidden fees. You only pay for the pages you send.

Compatibility: Faxaroo supports multiple file formats including PDF, PNG, GIF, JPEG.

Global Reach: Send faxes internationally to destinations like Australia, Canada, Japan, and Germany.

Unlimited Faxing: Send as many faxes as you need. With Faxaroo you can send a large fax (Up to 500 number of pages). Most free options restrict sending to a few pages per day or make users upgrade plans to send more.

Where to Fax IRS Documents?

Easy answer is Faxaroo! If you're searching for where can I fax something near me, Faxaroo is the easiest and most secure option. Avoid the hassle of finding a fax machine and ensure your tax forms are delivered reliably and securely with Faxaroo’s online fax service.

Send Your Fax Forms to the IRS With Faxaroo Today

Ready to file your tax? Send your fax forms to the IRS via Faxaroo’s simple online self-service portal today.

For more information on where you can file your taxes by fax, view the IRS’s Where to File Paper Tax Returns With or Without a Payment page.

The Best Way to Fax? Why Choose Faxaroo

Secure & Reliable

Faxaroo takes data protection seriously, with its ISO 27001 certification. All faxes are encrypted and processed via TLS encryption. Faxes are automatically deleted once they’ve been sent.

Pay Per Fax Page

Faxaroo works on a pay-as-you-go basis, meaning you can send faxes whenever you need to without being stuck on a monthly plan. If you only need to fax one-time, Faxaroo is a great, no-strings-attached option.

Easiest Way To fax

No sign-up required - only pay for the fax pages you send. It’s as easy as uploading your fax document to our fax platform and we’ll handle the rest.

Secure & reliable online faxing

Secure & reliable online faxing