Fax Your Form 8802 to the IRS Securely with Faxaroo

Are you currently working overseas but are a United States (U.S.) resident? Maybe you’re studying in a foreign company, but you may still be classified as a US resident. If you’re looking to claim income tax treaty benefits or certain other tax benefits, you may be required to provide proof of US residency. If this is the case, a US residency certificate can be obtained by completing and submitting the IRS form 8802.

Your form 8802 will need to be completed and returned to the IRS in order to receive your certificate. To ensure your form 8802 is sent and received by the IRS securely, we recommended choosing to fax your IRS form 8802 via Faxaroo.

What is a U.S. Residency Certification?

Many foreign countries require tax withholding on certain types of income paid from sources within those countries to U.S. entities, even if the recipient is a tax-exempt organization for U.S. income purposes. If there is an active income tax treaty between the U.S. and the foreign country, this may reduce or eliminate tax completely. To take advantage of this, you may need to prove your U.S. residency via a U.S. residency certification.

As defined by the University of Alabama, a U.S. residency certification (or form 6166) is a letter printed on U.S. Department of Treasury stationary that certifies that you are a listed resident of the United States for the purpose of U.S. taxation for the year indicated. Form 8802 is used to request form 6166. You can read more about form 8802 on the IRS website: https://www.irs.gov/forms-pubs/about-form-8802

How to Send Your IRS Form 8802 via Faxaroo

Sending your form 8802 via Faxaroo is simple. You first need to look at the requirements for sending the user fee payment electronically, which can be found here: https://www.irs.gov/individuals/international-taxpayers/form-8802-application-for-united-states-residency-certification-additional-certification-requests

You can fax up to 10 Forms 8802 (including all required attachments) up to a maximum of 100 pages

You must include a fax cover sheet stating the number of pages included in the transmission

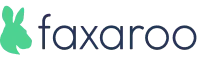

1. Upload your form 8802 to Faxaroo's secure web portal

You can do this by selecting the document from your device or using our easy drop and drag feature. Faxaroo supports multiple file formats including PDF, PNG, GIF and JPEG, so you can simply save your form 8802 as a document and send a fax to the IRS without worrying about incompatibility issues.

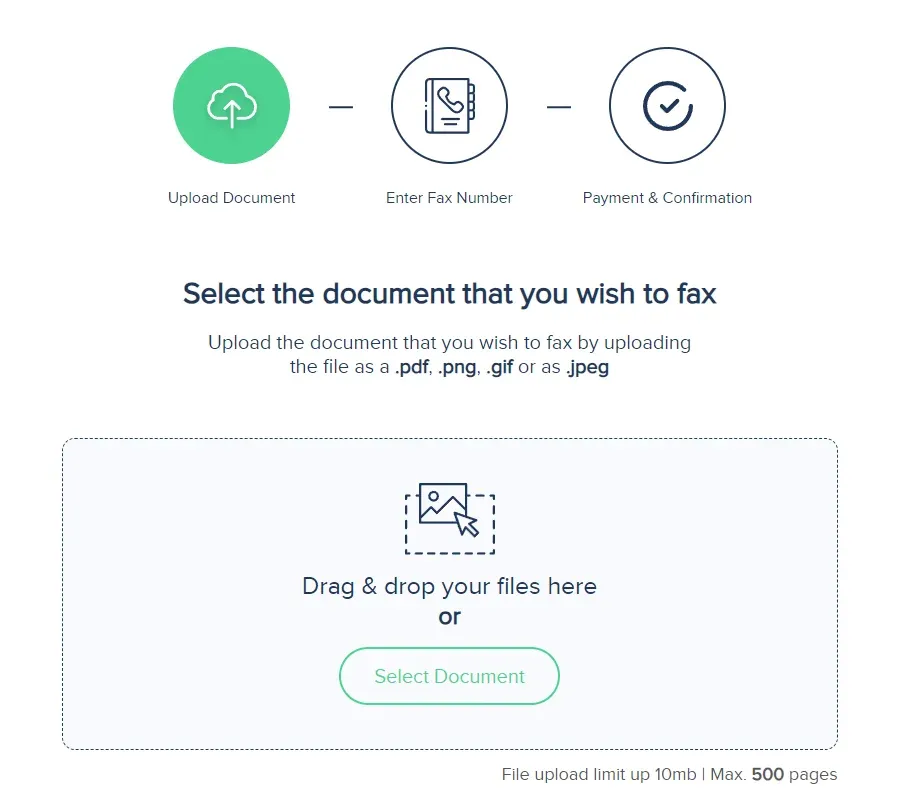

2. From the drop-down menu, select the USA and enter the correct IRS fax number for your Form 8802 submission.

Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. The following two fax numbers can be used, depending on where you currently reside:

877-824-9110 (within the United States only, toll-free)

304-707-9792 (inside or outside the United States, not toll-free)

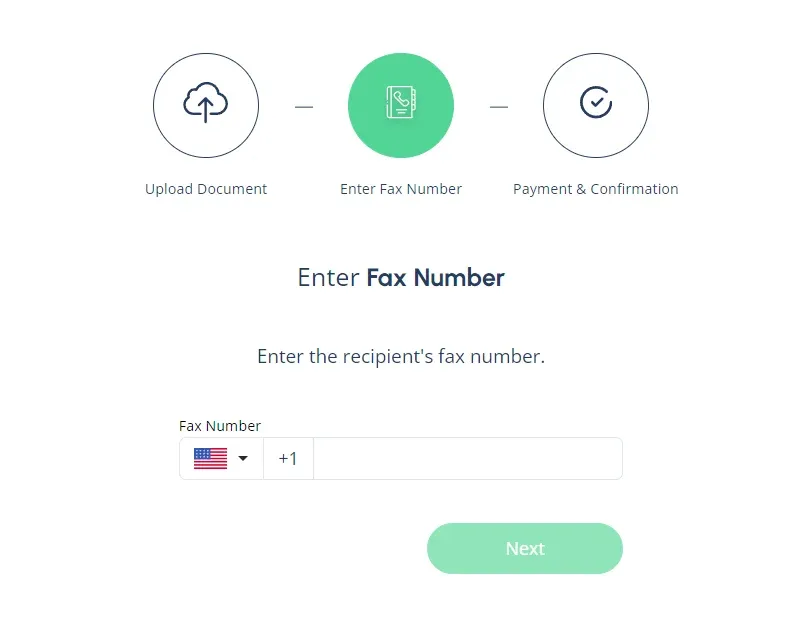

3.Select your payment method.

Once you’ve entered the correct IRS fax number to send your form 8802, the final step is to confirm payment. Faxaroo accepts payment via Visa or Mastercard. You’ll only be charged per page sent. Once you’ve entered your payment details and reviews your fax, hit send and we’ll take care of the rest. You’ll receive an automated email confirmation once your fax has been sent successfully.

Once you’ve entered your payment details, hit send and we’ll take care of the rest!

Why Send Your IRS Form 8802 via Faxaroo?

There are many reasons as to why sending your Form 8023 via Faxaroo instead of email or snail mail is the better alternative.

No sign up required: Makes faxing fast, no logins and passwords required - users don't have to remember yet another login.

Pay as you go: No subscriptions, meaning users aren’t required to pay monthly fees or worry about canceling after sending just one fax.

Security: Your documents are handled with care and confidentiality. Faxaroo is ISO 27001 certified, encrypted and processed via TLS encryption for ultimate security.

Accessibility: Faxaroo is compatible with all devices—smart phones, tablets, and computers—allowing you to send faxes fast while on the go.

Environmentally Friendly: Reduce paper waste with Faxaroo's digital faxing, contributing to a greener planet.

Reliability: Faxaroo provides instant fax confirmation of fax delivery via email, giving you peace of mind that your documents have reached their destination.

Low-cost fax: With Faxaroo, there are no hidden fees. You only pay for the pages you send.

Compatibility: Faxaroo supports multiple file formats including PDF, PNG, GIF, JPEG.

Global Reach: Send faxes internationally to destinations like the Australia, Canada, Japan, and Germany.

Send as many pages as you need: User can send a large fax (Up to 500 number of pages). Most free fax options restrict sending to a few pages per day or make users upgrade plans to send more.

Send Your 8802 Form to the IRS Today

Ready to get your U.S. residency certificate? Send your form 8802 to the IRS via Faxaroo’s simple online self-service portal today.

The Best Way to Fax? Why Choose Faxaroo

Secure & Reliable

Faxaroo takes data protection seriously, with its ISO 27001 certification. All faxes are encrypted and processed via TLS encryption. Faxes are automatically deleted once they’ve been sent.

Pay Per Fax Page

Faxaroo works on a pay-as-you-go basis, meaning you can send faxes whenever you need to without being stuck on a monthly plan. If you only need to fax one-time, Faxaroo is a great, no-strings-attached option.

Easiest Way To fax

No sign-up required - only pay for the fax pages you send. It’s as easy as uploading your fax document to our fax platform and we’ll handle the rest.

Secure & reliable online faxing

Secure & reliable online faxing