Securely & Reliably Fax Form 8023 to the IRS with Faxaroo

Until further notice, the IRS is accepting taxpayer’s completed Form 8023, Elections Under Section 338 for Corporations Making Qualified Stock Purchases via fax. Form 8023, as defined by the IRS, is required to make elections under section 338 for a corporation (the “target” corporation) if the purchasing corporation has made a qualified stock purchase (QSP) of the target corporation. For more information on definitions, who must file and when and where to file, visit the IRS website: https://www.irs.gov/pub/irs-pdf/i8023.pdf If you’re looking to file a Form 8023, don’t rely on insecure mail. To ensure your completed Form 8023 is sent and received by the IRS securely, we recommend choosing Faxaroo, our preferred hassle-free and cost-effective pay-as-you-go online faxing service

How to Fax Your Form 8023 to the IRS Via Faxaroo

Sending your Form 8023 via Faxaroo is simple. Be sure to include a cover sheet when faxing your Form 8023 to the IRS. The cover sheet should include the following information set out on the IRS website: https://www.irs.gov/newsroom/taxpayers-can-now-fax-form-8023-elections-under-section-338-for-corporations-making-qualified-stock-purchases

You can use one of our free cover sheet templates here: https://faxaroo.com/us/free-fax-cover-sheets-and-templates/

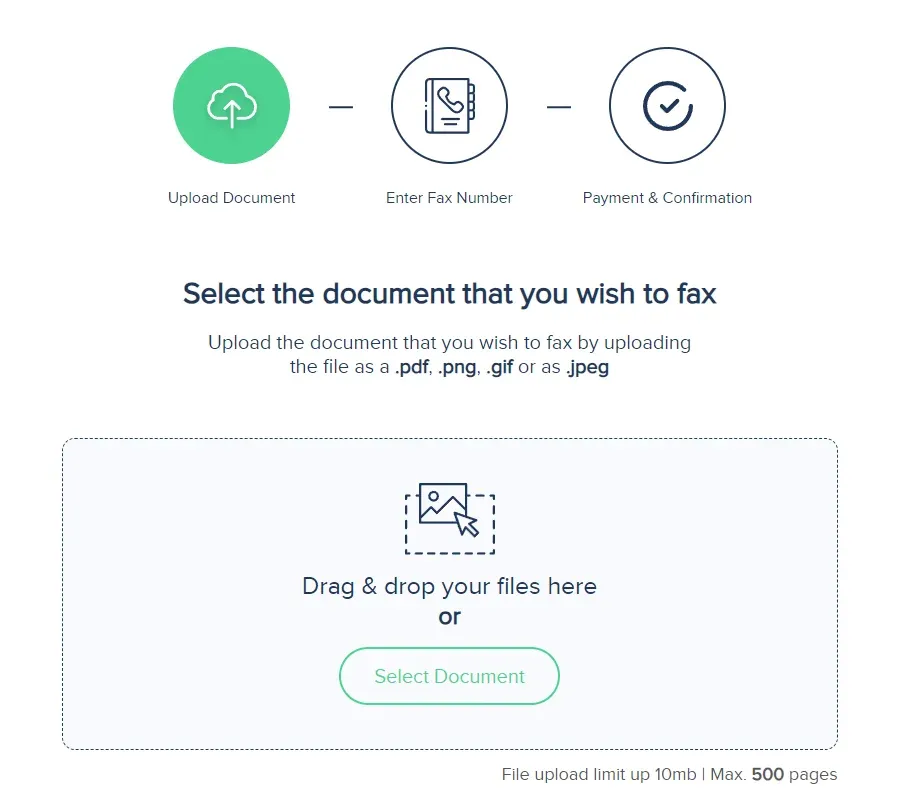

1. Upload your document to Faxaroo’s secure web portal.

You can do this by selecting the document from your device or using our easy drop and drag feature. Faxaroo supports multiple file formats including PDF, PNG, GIF and JPEG, so you can simply save your IRS form as a document and send a fax to the IRS without worrying about incompatibility issues.

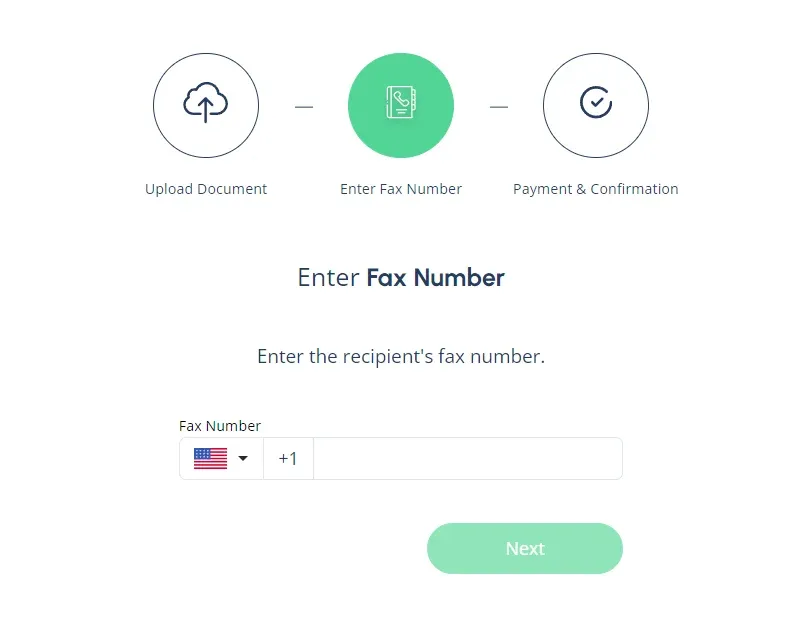

2. From the drop-down menu, select the USA and enter the correct IRS fax number for your Form 8023 submission. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Fax your Form 8023 submission to the following IRS fax number: 844-253-9765.

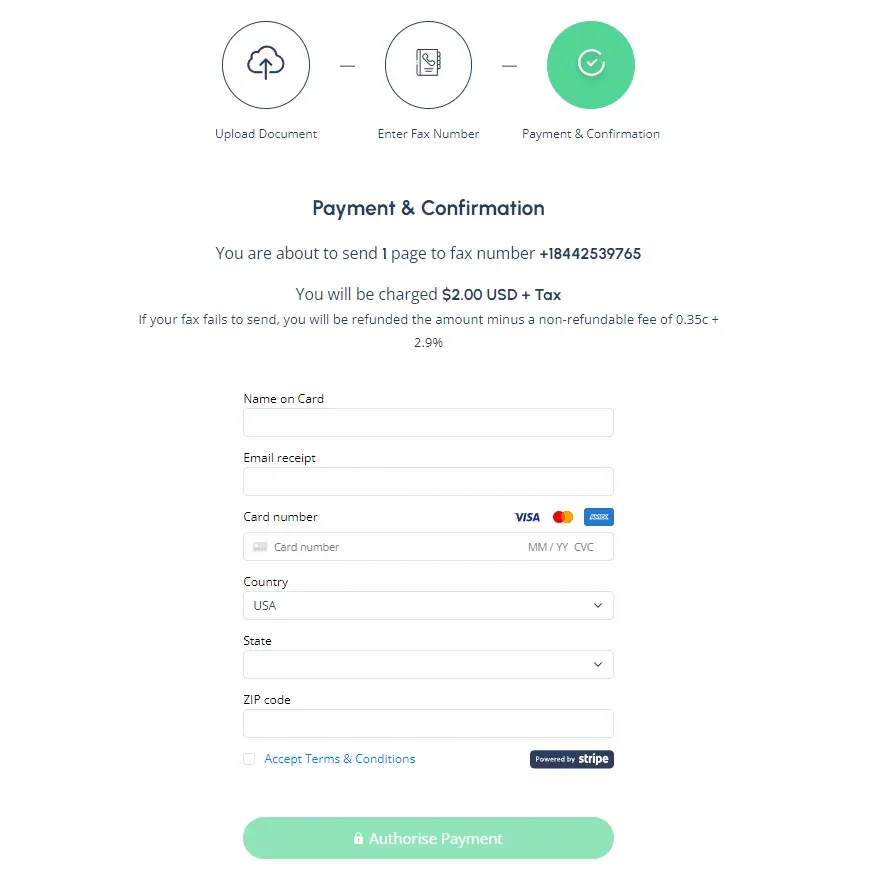

3.Select your payment method. Once you’ve entered the correct IRS fax number to send your Form 8023, the final step is to confirm payment. Faxaroo accepts payment via Visa or Mastercard. You’ll only be charged per page sent. Once you’ve entered your payment details and reviews your fax, hit send and we’ll take care of the rest. You’ll receive an automated email confirmation once your fax has been sent successfully.

Once you’ve entered your payment details, hit send and we’ll take care of the rest!

Why Send Your IRS Form 8023 via Faxaroo?

There are many reasons as to why sending your Form 8023 via Faxaroo instead of email or snail mail is the better alternative.

- Security – sending your fax via email or through the post is insecure, whereas with Faxaroo, faxes are encrypted and processed via TLS encryption for ultimate security, giving you peace of mind. Faxes are also automatically deleted from Faxaroo’s system once they’ve been sent.

- Verification – receive verification of successful fax delivery, so you know that your Form 8023 has been sent successfully. Print or save your confirmation for future reference.

- Reliability – better than wondering if your email has landed in the correct inbox, or if your post documents have gotten lost. Sending your IRS form via Faxaroo is a reliable way to get your sensitive information where it needs to go, fast.

- Availability – Faxaroo makes it easy to send your form 8023 to the IRS no matter where you are, what time it is and what device you’re using.

- Compatibility – Faxaroo supports multiple file formats including PDF, PNG, GIF, JPEG.

- Cost – Faxaroo’s competitive pricing means it’s the cheapest way to send your form 8023 to the IRS. Forget printing a bunch of pages and wasting money on paper and ink, sending a fax only costs USD $2 for the first page and USD $1.50 for each additional page.

Fax Your Form to the IRS Today

File your Form 8023 with the IRS via Faxaroo’s simple online self-service portal today.

For more information on Form 8023, view the IRS instructions here: https://www.irs.gov/pub/irs-pdf/i8023.pdf

Related articles:

Send your Form 2949 to the IRS surely via fax

Apply for an EIN number via fax

Fax your form 8802 to the IRS securely with Faxaroo

The Best Way to Fax? Why Choose Faxaroo

Secure & Reliable

Faxaroo takes data protection seriously, with its ISO 27001 certification. All faxes are encrypted and processed via TLS encryption. Faxes are automatically deleted once they’ve been sent.

Pay Per Fax Page

Faxaroo works on a pay-as-you-go basis, meaning you can send faxes whenever you need to without being stuck on a monthly plan. If you only need to fax one-time, Faxaroo is a great, no-strings-attached option.

Easiest Way To fax

No sign-up required - only pay for the fax pages you send. It’s as easy as uploading your fax document to our fax platform and we’ll handle the rest.

Secure & reliable online faxing

Secure & reliable online faxing