Apply for an EIN Number Via Fax

What is an Employer Identification Number (EIN)?

As defined by the IRS, an Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is used to identity a business entity. This identification is required if a business is operating with employees and plans to pay tax within the United States. You’ll need to apply for your EIN number early enough to ensure you have it before the tax return deadline.

You can learn more about an EIN, how long it will take to get one and if you need an EIN for your business on the IRS website: https://www.irs.gov/businesses/small-businesses-self-employed/employer-id-numbers

How do I Apply for an EIN?

The best way to apply for an EIN is via fax by completing Form SS-4. Form SS-4 is an application form for an EIN. With the form only being one page, it shouldn’t take too long for you to complete. After ensuring that the Form SS-4 contains all required information, it’s time to apply for your EIN by faxing your completed Form SS-4 to the IRS. Here’s how:

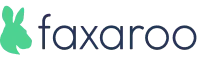

1. Upload your Form SS-4 to Faxaroo's secure web portal.

You can do this by selecting the document from your device or using our easy drop and drag feature. Faxaroo supports multiple file formats including PDF, PNG, GIF and JPEG, so you can simply save your Form SS-4 as a document and send a fax to the IRS without worrying about incompatibility issues.

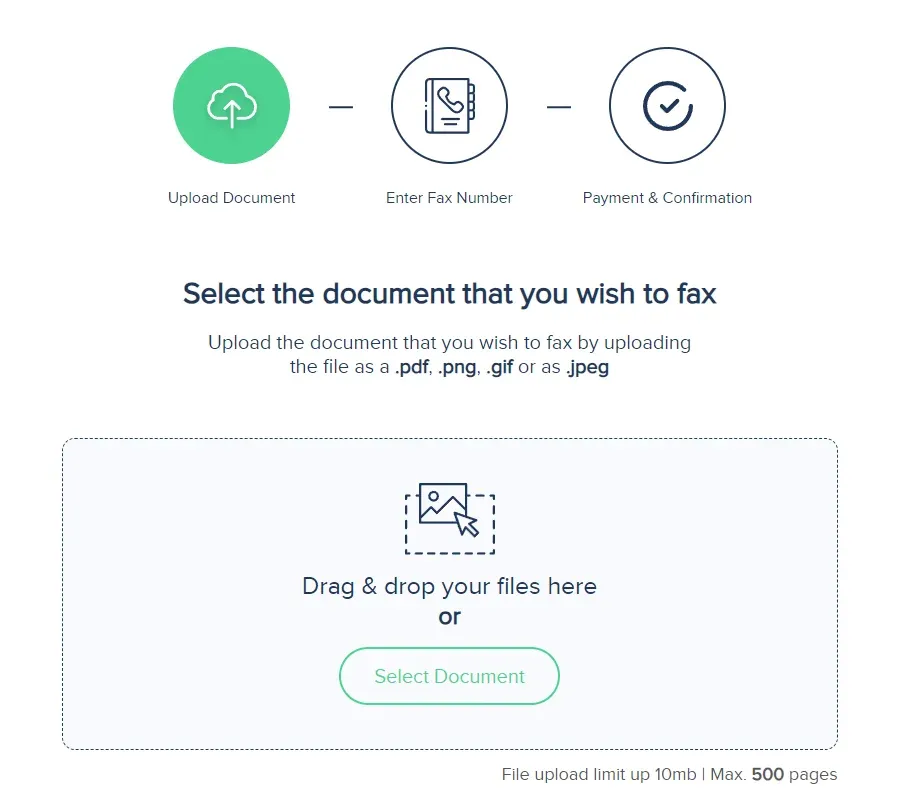

2. From the drop-down menu, select the USA and enter the correct IRS fax number for your form SS-4 submission.

Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. The following three fax numbers can be used, depending on if your principal business, office or agency, or legal residence in the case of an individual, is located in:

One of the 50 states or the District of Columbia: 855-641-6935

If you have no legal residence, principal place of business, or principal office or agency in any state: 855-215-1627 (within the U.S.) or 304-707-9471 (outside of the U.S.)

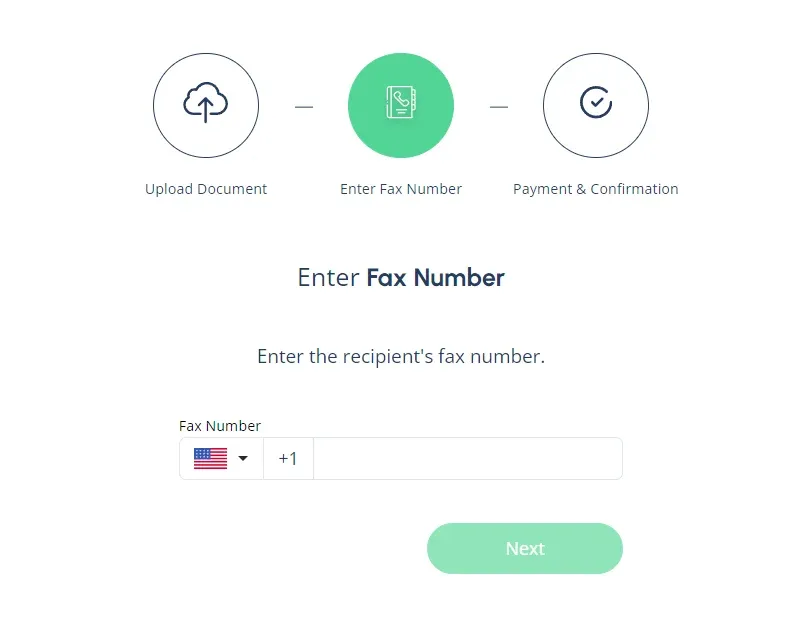

3.Select your payment method.

Once you’ve entered the correct IRS fax number to send your Form SS-4, the final step is to confirm payment. Faxaroo accepts payment via Visa or Mastercard. You’ll only be charged per page sent. Once you’ve entered your payment details and reviews your fax, hit send and we’ll take care of the rest. You’ll receive an automated email confirmation once your fax has been sent successfully.

Once you’ve entered your payment details, hit send and we’ll take care of the rest!

Why Should I Apply for my EIN Number via Faxaroo?

There are many reasons as to why sending your Form 8023 via Faxaroo instead of email or snail mail is the better alternative.

- Security – sending your fax via email or through the post is insecure, whereas with Faxaroo, faxes are encrypted and processed via TLS encryption for ultimate security, giving you peace of mind. Faxes are also automatically deleted from Faxaroo’s system once they’ve been sent.

- Verification – receive verification of successful fax delivery, so you know that your Form 8023 has been sent successfully. Print or save your confirmation for future reference.

- Reliability – better than wondering if your email has landed in the correct inbox, or if your post documents have gotten lost. Sending your IRS form via Faxaroo is a reliable way to get your sensitive information where it needs to go, fast.

- Availability – Faxaroo makes it easy to send your form 8023 to the IRS no matter where you are, what time it is and what device you’re using.

- Compatibility – Faxaroo supports multiple file formats including PDF, PNG, GIF, JPEG.

- Cost – Faxaroo’s competitive pricing means it’s the cheapest way to send your form 8023 to the IRS. Forget printing a bunch of pages and wasting money on paper and ink, sending a fax only costs USD $2 for the first page and USD $1.50 for each additional page.

Apply for Your EIN Number via Fax Today!

Ready to get your EIN? Submit your Form SS-4 via Faxaroo’s simple online self-service portal today.

For more information, head to the IRS website on how to apply for an EIN and where to file your taxes (Form SS-4).

The Best Way to Fax? Why Choose Faxaroo

Secure & Reliable

Faxaroo takes data protection seriously, with its ISO 27001 certification. All faxes are encrypted and processed via TLS encryption. Faxes are automatically deleted once they’ve been sent.

Pay Per Fax Page

Faxaroo works on a pay-as-you-go basis, meaning you can send faxes whenever you need to without being stuck on a monthly plan. If you only need to fax one-time, Faxaroo is a great, no-strings-attached option.

Easiest Way To fax

No sign-up required - only pay for the fax pages you send. It’s as easy as uploading your fax document to our fax platform and we’ll handle the rest.

Secure & reliable online faxing

Secure & reliable online faxing