Send Your Form 2848 to the IRS Securely Via Fax

A major part of planning for the future is power of attorney. A power of attorney may be required in many circumstances and provides you with peace of mind when it comes to ensuring your finances and other aspects of your personal dealings are kept in order while you are unable to do so yourself. If you’re looking to authorize someone with power of attorney, you’ll need to apply via the IRS by filing for 2848, Power of Attorney and Declaration of Representative. We dive into what a Form 2848 is, its purpose and where to file it and how to file it via fax below.

What is Form 2848 and What is its Purpose?

IRS Form 2848, Power of Attorney and Declaration of Representative is used to designate an individual to act on your behalf for tax matters. In short, it’s used to file for IRS power of attorney and authorizes an attorney, family member or accountant with the ability to represent you before the IRS. A power of attorney authorization may be needed in many different situations, including:

- You need to give your attorney the power to sell your house when you’re overseas.

- You need to give a family member power of attorney for healthcare decisions, such as if you are recovering from an incapacitating condition.

- You want someone to be able to sign documents on your behalf.

- You may be unable to look after yourself at some stage in the future, and therefore need someone to be able to act on your behalf .

Granting power of attorney should not be taken lightly. The individual you ask to look after your financial and legal affairs must be responsible, knowledgeable and experiences. Most importantly, you need to be able to trust them completely. Visit the IRS website to find out more about Form 2848, Power of Attorney and Declaration of Representative: https://www.irs.gov/forms-pubs/about-form-2848

Where Do I Fax Form 2848?

As per the IRS instructions on where to file your Form 2848:

| Location of residency | Fax Number |

|---|---|

| Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, or West Virginia | 855-214-7519 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, or Wyoming | 855-214-7522 |

| All APO and FPO addresses, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States. | 855-772-3156 |

Fax Form 2848 with Faxaroo in 3 Easy Steps!

The best way to file for a power of attorney authorization with the IRS is via fax. This is because online fax is a secure, reliable and cost-effective way to send sensitive information compared to other alternatives.

Once you’ve ensured that Form 2848 contains all required information, it’s time to apply for your power of attorney authorization. Here’s how.

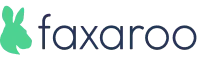

1. Upload your Form 2848 to Faxaroo’s secure web portal.

You can do this by selecting the document from your device or using our easy drop and drag feature. Faxaroo supports multiple file formats including PDF, PNG, GIF and JPEG, so you can simply save your Form 2848 as a document and send a fax to the IRS without worrying about incompatibility issues.

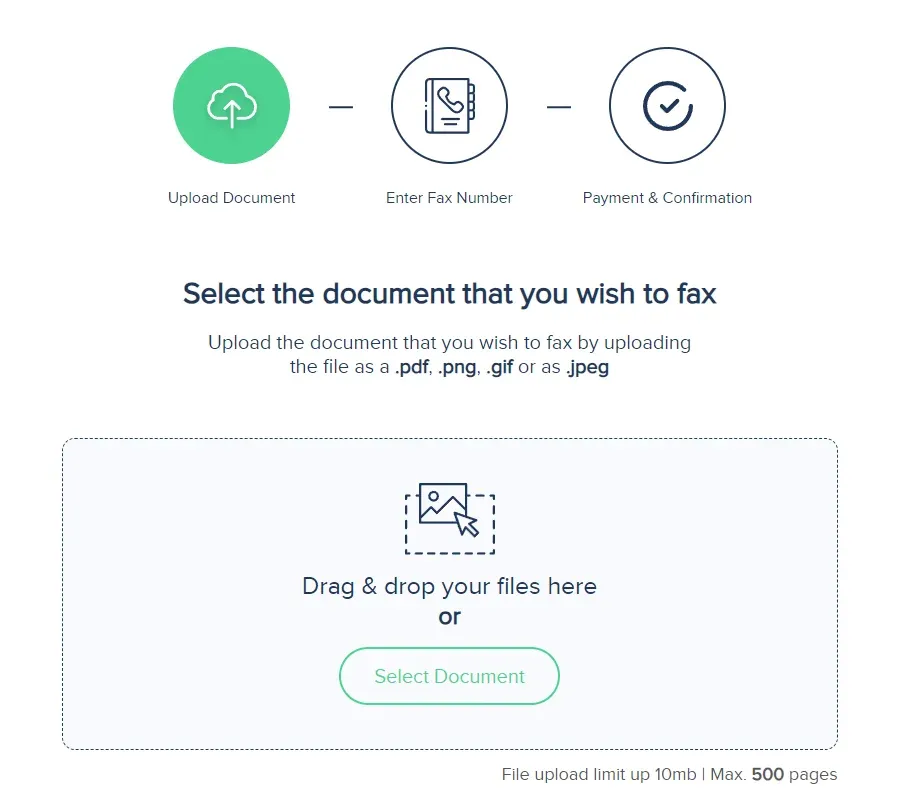

2. From the drop-down menu, select the USA and enter the correct IRS fax number for your Form 2848 submission. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. We have provided a list of IRS fax numbers above on where to fax your Form 2848, based on your residency.

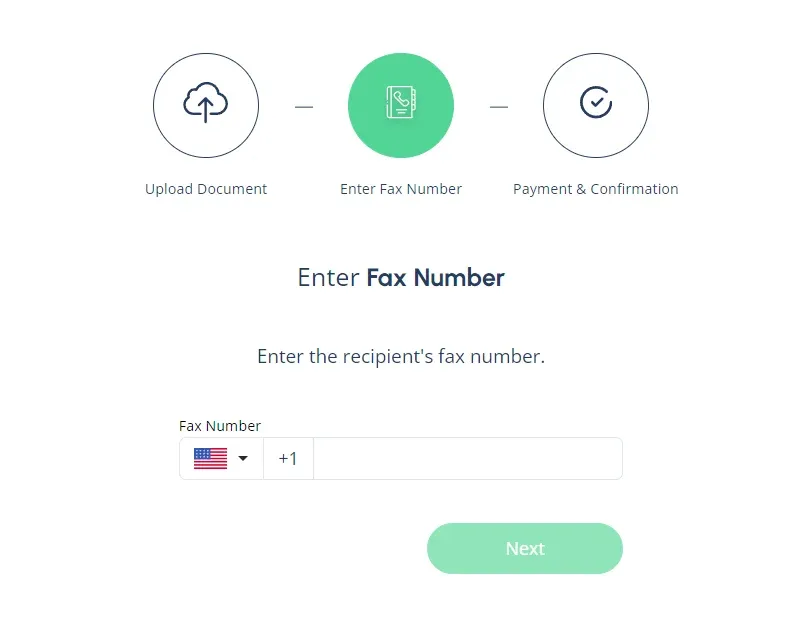

3.Select your payment method. Once you’ve entered the correct IRS fax number to send your Form 2848, the final step is to confirm payment. Faxaroo accepts payment via Visa or Mastercard. You’ll only be charged per page sent. Once you’ve entered your payment details and reviews your fax, hit send and we’ll take care of the rest. You’ll receive an automated email confirmation once your fax has been sent successfully.

Once you’ve entered your payment details, hit send and we’ll take care of the rest!

Why Send Your IRS Form 2848 via Faxaroo?

No sign up required: Makes faxing fast, no logins and passwords required - users don't have to remember yet another login.

Pay as you go: No subscriptions, meaning users aren’t required to pay monthly fees or worry about canceling after sending just one fax.

Security: Your documents are handled with care and confidentiality. Faxaroo is ISO 27001 certified, encrypted and processed via TLS encryption for ultimate security.

Accessibility: Faxaroo is compatible with all devices—smart phones, tablets, and computers—allowing you to send faxes fast while on the go.

Environmentally Friendly: Reduce paper waste with Faxaroo's digital faxing, contributing to a greener planet.

Reliability: Faxaroo provides instant fax confirmation of fax delivery via email, giving you peace of mind that your documents have reached their destination.

Low-cost fax: With Faxaroo, there are no hidden fees. You only pay for the pages you send.

Compatibility: Faxaroo supports multiple file formats including PDF, PNG, GIF, JPEG.

Global Reach: Send faxes internationally to destinations like the Australia, Canada, Japan, and Germany.

Send as many pages as you need: User can send a large fax (Up to 500 number of pages). Most free fax options restrict sending to a few pages per day or make users upgrade plans to send more.

File Your Power of Attorney Forms With Faxaroo Today

Submit your Form 2848 Power of Attorney and Declaration of Representative via Faxaroo’s simple online self-service portal today.

For more information, head to the IRS website to learn more about Form 2848 and instructions for Form 2848.

The Best Way to Fax? Why Choose Faxaroo

Secure & Reliable

Faxaroo takes data protection seriously, with its ISO 27001 certification. All faxes are encrypted and processed via TLS encryption. Faxes are automatically deleted once they’ve been sent.

Pay Per Fax Page

Faxaroo works on a pay-as-you-go basis, meaning you can send faxes whenever you need to without being stuck on a monthly plan. If you only need to fax one-time, Faxaroo is a great, no-strings-attached option.

Easiest Way To fax

No sign-up required - only pay for the fax pages you send. It’s as easy as uploading your fax document to our fax platform and we’ll handle the rest.

Secure & reliable online faxing

Secure & reliable online faxing